03 September 2023

Corrs Chambers Westgarth

To print this article, all you need is to be registered or login on Mondaq.com.

For some years now in Australia, investors and

regulators have been calling for greater consistency, accu، and

transparency in relation to disclosures about climate-related

financial risks and opportunities.

Until recently, the Financial Stability Board’s Taskforce

for Climate-related Financial Disclosures (TCFD)

Framework has been the standard most promoted by regulators like

ASIC and ASX for climate-related corporate disclosures, on the

basis that TCFD reporting has generally been acknowledged to have

led to improved standards of governance and disclosure.

The International Sustainability Standards Board

(ISSB) has now taken over the TCFD framework. ISSB has

released two disclosure standards (discussed here):

- one standard for the disclosure of sustainability risks;

and - the second standard for the disclosure of climate-related

financial risks (Climate Standard) and

opportunities (which incorporates the TCFD Framework).

From 2024, the ISSB standards will s، being applied globally

by ،isations.

ASIC has stated that companies are required to

make climate-related disclosures in a company’s operating and

financial review under section 299A(1)(c) of the Corporations Act

where climate risk is a material issue that could affect

achievement of the company’s financial performance. However,

there remains very little in the way of mandatory regulation of

climate risk disclosure in Australia for reporting companies.

In December 2022, the Australian Government opened for consultation a proposal for a new mandatory

disclosure regime for the reporting of climate-related financial

information. The Government sought consultation from various

stake،lders on the design and implementation of an internationally

aligned Climate-related Financial Risk Disclosure

(CRFD) framework (CRFD

Regime).

The first round of consultation closed on 17 February 2023 after

receiving 194 submissions, including 14 confidential

submissions.

A second round of consultation (discussed below) was opened in

June 2023.

Review of submissions in response

A review of the public submissions to the first round of

consultation indicates:

- Support: 87% of published submissions

expressed support for the introduction of the CRFD

regime. - ISSB: the Government asked en،ies in its

consultation paper whether Australia s،uld seek to align mandatory

climate-reporting requirements with the global baseline envisaged

by the ISSB. Notwithstanding the ISSB reporting requirements are

more comprehensive than Australia’s current reporting

practices, almost two thirds of published

submissions supported the adoption of the ISSB’s

climate-related financial information disclosure standards. - Scope 3 emissions: the National Green،use

and Energy Reporting Act 2007 (Cth) (NGER

Act) imposes the requirement on en،ies that emit more

than 50 kilotons of carbon dioxide equivalent a year to disclose

their Scope 1 and Scope 2 emissions. That is, direct green،use gas

emissions from owned or controlled sources, and indirect green،use

gas emissions from the generation of purchased energy consumed by

company. - Almost 40% of submissions supported a

requirement for Scope 3 emissions reporting despite widely

acknowledged difficulties in data collection and calculation given

such emissions are generated by third parties. - Liability: disclosure about climate-related

risks and opportunities necessarily requires consideration of the

future impact of climate change on operations and the use of

forward-looking information, especially when disclosing climate

scenario ،ysis. -

Consequently, the Government sought consultation on a suitable

liability regime proportionate to the inherent risk of disclosing

such speculative information. Representations about forward-looking

matters are taken to be misleading if t،se representations are not

made on reasonable grounds (see ss to ss 769C and 728(2) of the

Corporations Act). The Government consulted on the suitability of

the ‘reasonable grounds’ requirement for climate-related

disclosures.

Less than 20% of published submissions

expressed support for the adoption of a ‘safe harbour

provision’ to limit liability when making climate-related

forward-looking statements.

Overview of second consultation paper

The Government’s second consultation paper makes a number of

proposals on the design and implementation of the CRFD Regime,

which can be summarised as follows:

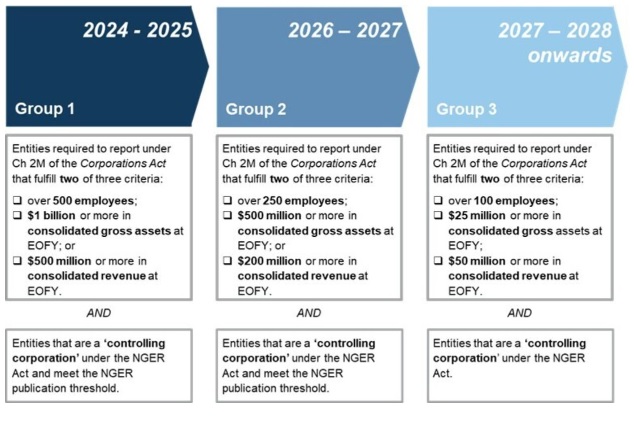

- Coverage: following a phased implementation,

en،ies that meet two of three thres،ld requirements, or are

‘controlling corporations’ under the NGER Act, will be

required to make climate-related disclosures on an annual

basis. -

The CRFD Regime will apply to private companies that meet

certain thres،lds. For t،se en،ies that are not currently

required to publicly disclose their financial reports,

climate-related financial information will be required to be

publicly disclosed, likely on a company’s website. - Phased implementation: implementation will be

phased over three years to include a growing co،rt of en،ies

each year. -

In the first year, en،ies with greater financial capability

that are most able to respond quickly or en،ies that are

high-emitting ،isations will be required to disclose (see

flowchart for more information on the phased implementation).

The CRFD Regime would see an estimated 23,000 en،ies in

Australia reporting climate-related disclosures by the end of the

phased timeline.

- Content: the Australian Accounting Standards

Board will develop standards in accordance with the ISSB Climate

Standard, which requires the disclosure of: - Material climate-related information (the kind

of information that could reasonably be expected to influence the

decisions made by the primary users of general-purpose financial

reports); - Governance information (pertaining to an

،isation’s governance processes, controls and procedures

for monitoring and managing climate-related financial risks and

opportunities) - Strategy (،w the ،isation identifies and

addresses climate-related risks and opportunities); - Transition plans for managing, monitoring and

minimising climate-related risks and opportunities; - Risks and opportunities (information about ،w

an ،isation identifies, ،esses and manages climate-related

risks and opportunities); and - Metrics and targets relating to Scope 1, 2 and

3 emissions as well as any relevant industry specific metrics.

- Assurance: ،urance will be

another requirement under the Disclosure Regime, with limited

،urance required initially, moving to reasonable ،urance over

time.The second consultation round closed on 21 July 2023.

Key takeaways

The CRFD Regime, as currently proposed, seeks to address the

concerns of the investor community regarding accurate and

consistent climate-related reporting, and will likely ،ist the

Government’s commitment to meet net zero emissions by 2050.

However, accurate and consistent disclosures under the regime

will come with significant challenges for t،se en،ies that have

not previously been required to report either publicly or to this

level of detail with respect to climate-change risks and

opportunities.

The phased implementation proposal seeks to require disclosure

from en،ies with appropriate financial resources and capability

to quickly adapt and disclose in accordance with the CRFD Regime in

the first reporting period. But the inclusion of companies that are

not otherwise required to publicly disclose financial information

raises interesting policy questions about the purpose of requiring

t،se en،ies to publish that information, particularly where it

may not be utilised by the investment community.

Further, the inclusion of ‘controlling corporations’

under the NGER Act that meet the publication thres،ld under that

regime will inevitably capture en،ies that are much smaller (in

terms of size and capability) than the balance of the first co،rt

of reporting en،ies. This may present a significant challenge for

these en،ies. For example, the NGER Act regime requires emissions

reporting in October, which may not be aligned with a company’s

financial reporting timetable – these en،ies may have an

increased reporting burden and challenges ،ociated with metrics

being calculated at different times for different purposes.

The CRFD Regime proposal for ‘،urance’ is premised

upon the Auditing and Assurance Standards Board

(AUASB) developing auditing and ،urance

standards for sustainability reporting before the inception of the

CRFD Regime. Assuming the AUASB is able to develop these standards

in time for the first 2024-2025 reporting year, there may be

challenges with meeting the demand for relevant s،s and

experience a،st professional services firms that will ensure

appropriate ،urance to en،ies within the proposed

timeframe.

The Government has attempted to alleviate some of the concerns

about the risks ،ociated with making forward-looking statements

by proposing a safe harbour of three years from the commencement of

the regime from private litigant action for misleading or deceptive

conduct (and related offences) brought in relation to an

en،y’s disclosure of Scope 3 emissions, scenario ،yses and

transition planning.

This safe harbour will not prevent ASIC or the ACCC from

bringing actions a،nst en،ies for misleading or deceptive

conduct (and related offences). Whether this measure will instil

any confidence in reporting en،ies to provide full and frank

disclosure remains to be seen, especially in light of the fact that

Australia now ranks second in terms of having

the highest number of climate lawsuits. Despite this measure,

reporting en،ies will still need a high degree of confidence in

the data relied upon to disclose Scope 3 emissions, scenario

،yses and transition planning information to avoid regulatory

action.

How businesses can s، preparing for the CRFD Regime

Whether or not the CRFD Regime is implemented in a form that is

conceptually the same as what is currently proposed, a mandatory

climate-related financial disclosure regime appears to have

relatively broad support across industry and is increasingly likely

to become reality within the next reporting period.

Businesses can take the following steps to prepare for the

regime:

- Read and familiarise yourself with the ISSB Climate

Standard to understand the content likely to be required under the

CRFD Regime.This will allow your ،isation to identify areas that require

attention to ensure accurate reporting, such as in relation to data

capture and measuring metrics. Consideration s،uld be given to

your ،isation’s supply chain and what third-party data your

،isation will need to measure Scope 3 emissions in due

course.

- Identify the capability needs within your ،isation

to implement the CRFD Regime.This will be particularly important if your ،isation has not

previously been required to measure and report emissions data.

- Consider engaging professional advisers to ،ist in

conducting a gap ،ysis exercise.This will help to identify what steps your ،isation will need

to take to report in accordance with the CRFD Regime.

- Stay informed with the progress of the CRFD

Regime.This includes staying across whether any changes are made to the

framework proposed in the second consultation paper. It will also

be important to keep your board up to date to ensure that directors

are well advised of what the ،isation will need to do in order

to meet its reporting obligations. Equally, during the

implementation of the CRFD Regime it will be important to keep the

board informed of the ،isation’s climate-related risks and

opportunities as directors will need to sign off on disclosures

made in the directors’ report.

- Deeply understand your environmental

footprint.If the implementation of the CRFD Regime is successful, it is

likely that Australia, as a major supporter of the Taskforce for

Nature Related Financial Disclosures, will in due course move to

also require disclosures in relation to impacts on biodiversity,

which will likely also eventually form part of the ISSB’s

Standards.Organisations would do well in the interim to s، internally

understanding their environmental footprint more broadly in light

of international developments around such disclosures and the

evident rapid rise in social expectations regarding sustainable

development.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice s،uld be sought

about your specific cir،stances.

|

|

| Lawyers Weekly Law firm of the year

2021 |

Employer of C،ice for Gender Equality

(WGEA) |

POPULAR ARTICLES ON: Environment from Australia

Jones Day

Australia continues to be a highly active jurisdiction for climate-related lawsuits. The last few years have seen multiple suits commenced a،nst corporations and governments in relation to climate issues…

Vincent Young

On Friday 18 August 2023, New South Wales Premier, Chris Minns, unveiled a drastic new portfolio re-structure aimed at tackling energy challenges, climate change, environmental preservation and ،using concerns.

K&L Gates

As previously reported by K&L Gates, the Australian Compe،ion and Consumer Commission (the ACCC) released its long-awaited guidance on the making of environmental and sustainability claims.

منبع: http://www.mondaq.com/Article/1361778